are taxes taken out of instacart

I dont have any to suggest as I use a spreadsheet personally. Justin Krumbah 38 died on Monday after suspected gunman Aaron.

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

These things impact your.

. Then complete the contact form and we will instantly email you a quote. But your state and municipality may also expect you to pay taxes. Plan ahead to avoid a surprise tax bill when tax season comes.

To find out additional look at the Complete Guide to Self-Employment Taxes in 2019. Tax Deductions You Can Claim As An Instacart Driver. IRS deadline to file taxes.

If you make more than 600 per tax year theyll send you a 1099-MISC tax form. Taxes and fees Like any other service or product taxes are included in the order total on your delivery receipt thats emailed to you upon the completion of your order. 5-day early program may change or discontinue at any time.

Self Employment taxes are based only on your business profits. Because Instacart shoppers are contractors the company will not take taxes out of your paycheck. To make saving for taxes easier consider saving 25 to 30 of every payment and putting the money in a different account.

All companies including Instacart are only required to provide this form if they paid you 600 or more in a given tax year. Instacart will file your 1099 tax form with the IRS and relevant state tax authorities. So you get social security credit for it when you retire.

Therere several apps out there. To pay your taxes youll generally need to make quarterly tax payments estimated taxes. For most Shipt and Instacart shoppers you get a deduction equal to 20 of your net profits.

Up to 5 days early access to your federal tax refund is compared to standard tax refund electronic. You dont send the form in with your taxes but you use it to figure out how much to report as income when you file your taxes. Because your taxes wont be withheld from your pay itll be your.

Check out our self-employment tax deductions explorer for a complete list of all the different kinds of write-offs you might be eligible for based on the type of work you do. The taxes on your Instacart income wont be high since most drivers are making around 11 every hour. To file your taxes just click on Book Tax Appointment.

For the most part this guide covers federal taxes. If youre thinking about making money with Instacart or are already working as an Instacart shopper youre already on the right track. Instacart doesnt take taxes out because its a contractor job which is understandable but what do yall do around tax season.

The two taxes are figured individually from one another. Can you deduct your retirement contributions. You dont get the QBI deduction on the 153 in self-employment taxes.

Instacart is one of the most popular grocery delivery services out there. Its the money thats left over that is the basis for your taxes. This is a standard tax form for contract workers.

Thankfully you wont need to pay taxes on everything you earn from Instacart. Deductions are important and the biggest one is the standard mileage deduction so keep track of your miles. You pay 153 SE tax on 9235 of your Net Profit greater than 400.

That means youd only pay income tax on 80 of your profits. State and municipal taxes. If your income is above that then up to 85 is taxable income.

If your income is higher than that then up to 85 of your benefits may be taxable. For income tax your business profits are added to any other income like W2 interest and investment income etc and then deductions and adjustments are applied to figure out the income tax. And in terms of side hustle ideas its also incredibly lucrative.

According to the IRS if you earned more than 400 this year as an independent contractor through Instacart alone you are required to pay self-employed taxes tips get taxed too. Instacart does not take out taxes for independent contractors. Skilled Instacart shoppers can regularly earn 15 to 25 per hour.

If you want to see your tax bill after deductions just subtract your annual business expenses from your 1099 income input field. The calculation above doesnt take tax deductions into account. What Happens if I Dont File Instacart Taxes.

Start Instacart Tax Return Instacart Shoppers Qualify for a Forgivable loan. The tax andor fees you pay on products purchased through the Instacart platform are. For simplicity my accountant suggested using 30 to estimate taxes.

No matter if youre gigging for DoorDash UberEats Grubhub or Instacart or all of them youre on the hook for taxes since none are taken out of your paycheck like they would under W2 employment. Except despite everything you have to put aside a portion of the cash you make every week to cover them. We can agree on that but youll have to pay them as a gig economist.

For a more detailed walk-through of estimated taxes check out our article How to Calculate and Pay Estimated Quarterly Taxes. Does Instacart take out taxes for its employees. You do get to take off the 50 ER portion of the SE tax as an adjustment on line 27 of the 1040.

Press J to jump to the feed. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. If you had 20000 in earnings and 10000 in expenses your profit is 10000.

Should I just save. The 10000 is the taxable income not the whole 20000 This is why you MUST track your miles driven and your expenses. You would face the same penalties as any other business that doesnt file taxes.

Youll need your 1099 tax form to file your taxes. This used to be reported to you on a 1099-MISC but that changed for tax year 2020. How do I update my tax information.

Then you will subtract the expenses from the income. Instacart has donated 50000 to the family of a shopper killed in a shooting at a Fred Meyer store in Richland Washington. For example you can deduct the cost of using your vehicle for business by claiming actual expenses or using the standard mileage deduction.

OK so taxes are boring. Or if you want to get straight to calculating use our Self-Employed Tax Calculator. You wont send this form in with your tax return but you will use it to figure out how much business income to report on your Schedule C.

Press question mark to learn the rest of the keyboard shortcuts Search within rInstacartShoppers rInstacartShoppers Log InSign Up User account menu Found the internet. You can review and edit your tax information directly in. This is a loan you do not pay back.

If you and your spouse file jointly youll owe taxes on half of your benefits if your joint income is in the 3200044000 range. The estimated rate accounts for Fed payroll and income taxes. Independent contractors can claim business expenses to reduce their taxable income.

Half of it is taxable if your income is in the 2500034000 range. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5 days early.

How To Get Instacart Tax 1099 Forms Youtube

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

How Much Do Instacart Shoppers Make The Stuff You Need To Know

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

What You Need To Know About Instacart 1099 Taxes

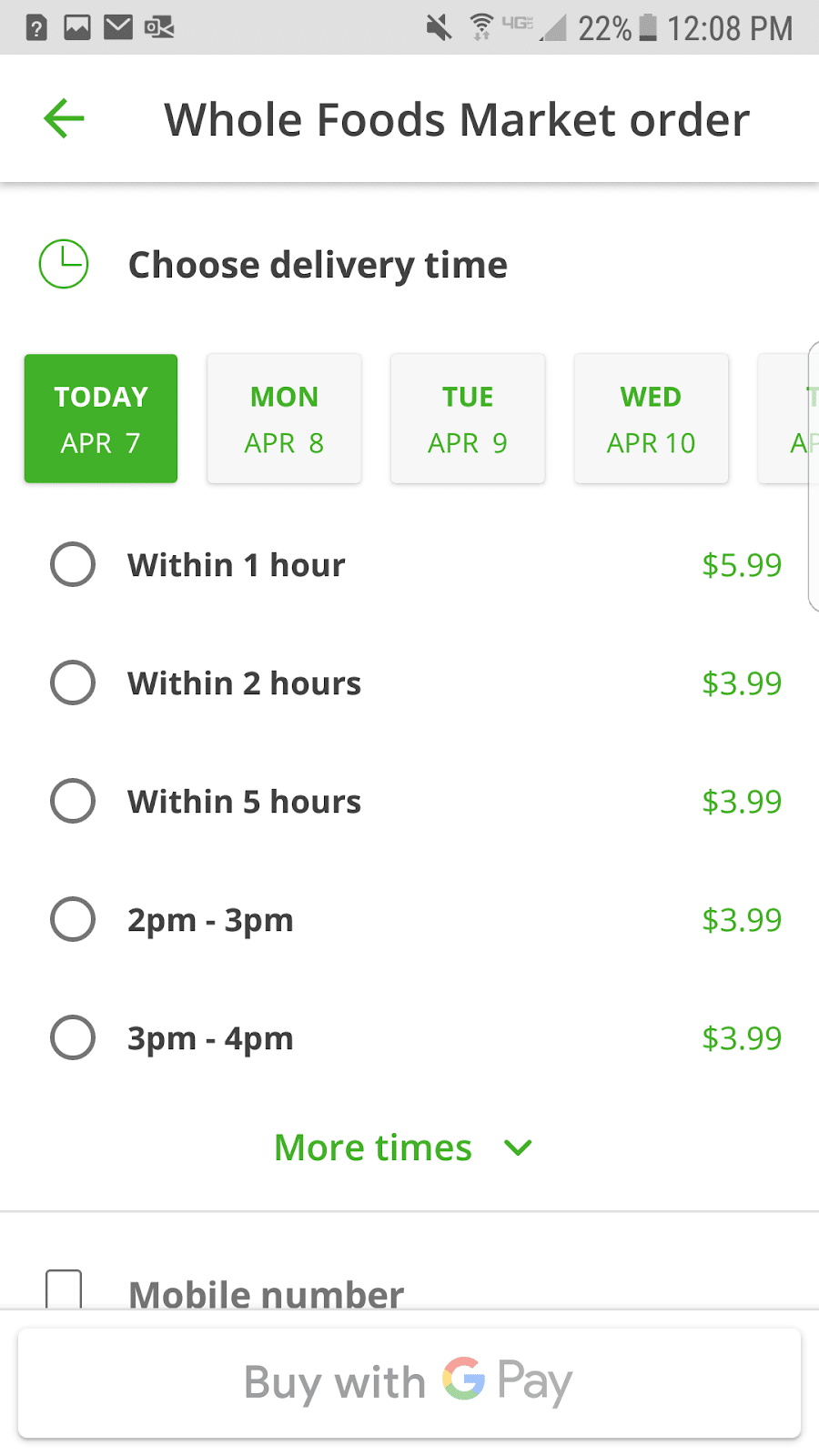

Instacart Fees Everything You Ll Pay As A Customer Explained

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Taxes The Complete Guide For Shoppers Ridester Com