nebraska sales tax rate

What is the sales tax rate in Columbus Nebraska. Form 10 and Schedules for Amended Returns and Prior Tax Periods.

What is the sales tax rate in Ashland Nebraska.

. Printable PDF Nebraska Sales Tax Datasheet. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. Sales and Use Taxes.

Did South Dakota v. The minimum combined 2022 sales tax rate for Ashland Nebraska is. Waste Reduction and Recycling Fee.

Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up. NE Sales Tax Calculator. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

Nebraska sales tax details. The minimum combined 2022 sales tax rate for Gretna Nebraska is. Groceries are exempt from the Nebraska sales tax.

The Nebraska state sales and use tax rate is 55. Average Sales Tax With Local. The Nebraska state sales and use tax rate is 55 055.

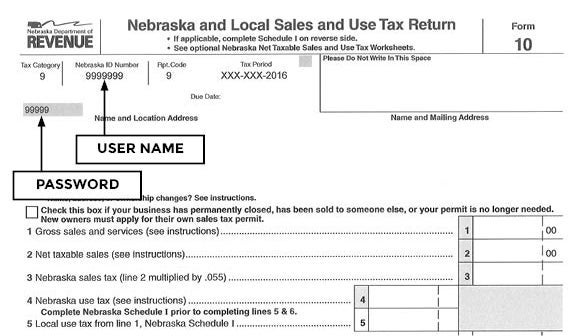

Demonstration of Filing State and Local Sales and Use Taxes Form 10 - Single Location Current Local Sales. Nebraska Application for Direct Payment Authorization 122020 20DP. This is the total of state county and city sales tax rates.

Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. With local taxes the total sales tax rate is between 5500 and 8000. ArcGIS Web Application - Nebraska.

This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Nemaha Nebraska is. What is the sales tax rate in Gretna Nebraska.

Find your Nebraska combined state. This is the total of state county and city sales tax rates. This is the total of state county and city sales tax rates.

The base state sales tax rate in Nebraska is 55. In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with.

What is the sales tax rate in Aurora Nebraska. Nebraska has recent rate changes Thu Jul 01 2021. The state sales tax rate in Nebraska is 5500.

The Nebraska NE state sales tax rate is currently 55. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription. Local Sales and Use Tax Rates Effective April 1 2021 Dakota County and Gage County each impose a tax rate of 05.

The County sales tax rate is 0. Sales Tax Rate Finder. The Columbus sales tax rate is 15.

The minimum combined 2022 sales tax rate for Aurora Nebraska is. 49 rows 75 Sales and Use Tax Rate Cards. FilePay Your Return.

See the County Sales and Use Tax Rates section at the. 536 rows Nebraska Sales Tax55. The Nebraska sales tax rate is currently 55.

Municipal governments in Nebraska. This is the total of state county and city sales tax rates. Counties and cities can charge an.

The minimum combined 2022 sales tax rate for Columbus Nebraska is 7. Nebraska has a 550 percent state sales tax rate a max local sales tax rate of 250 percent and an average combined state and local sales tax rate of 694 percent. What is the sales tax rate in Nemaha Nebraska.

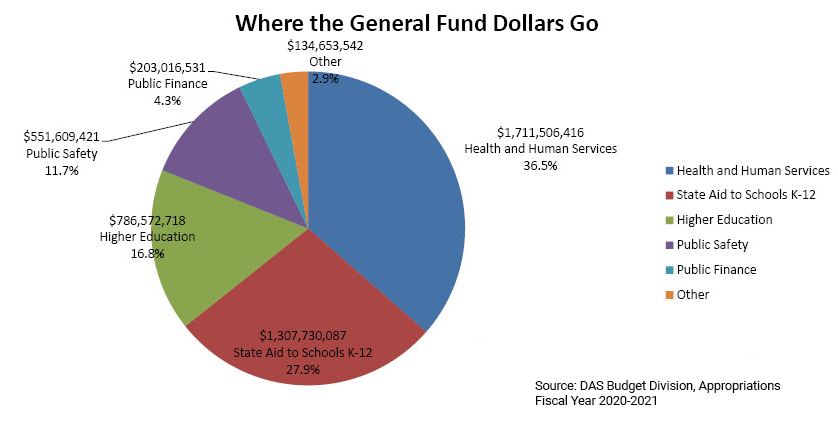

Taxes And Spending In Nebraska

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Income Tax Withholding Faqs Nebraska Department Of Revenue

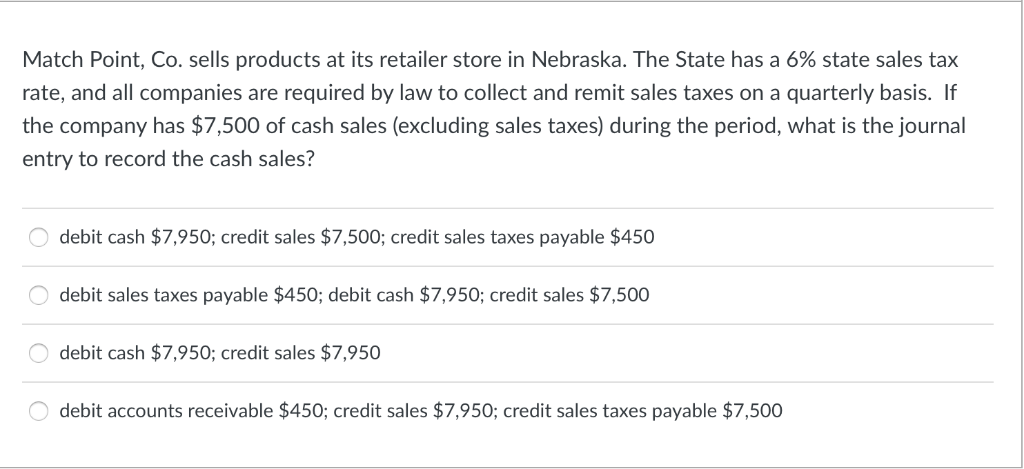

Solved Match Point Co Sells Products At Its Retailer Store Chegg Com

Nebraska Group Recommends Eliminating Some Sales Tax Breaks

Nebraska Sales Tax Rates By City County 2022

Nebraska Sales Tax Changes July 2015 Avalara

Sales Tax Rates Wine Software By Microworks

Get Your 2021 2022 Nebraska State Income Tax Return Done

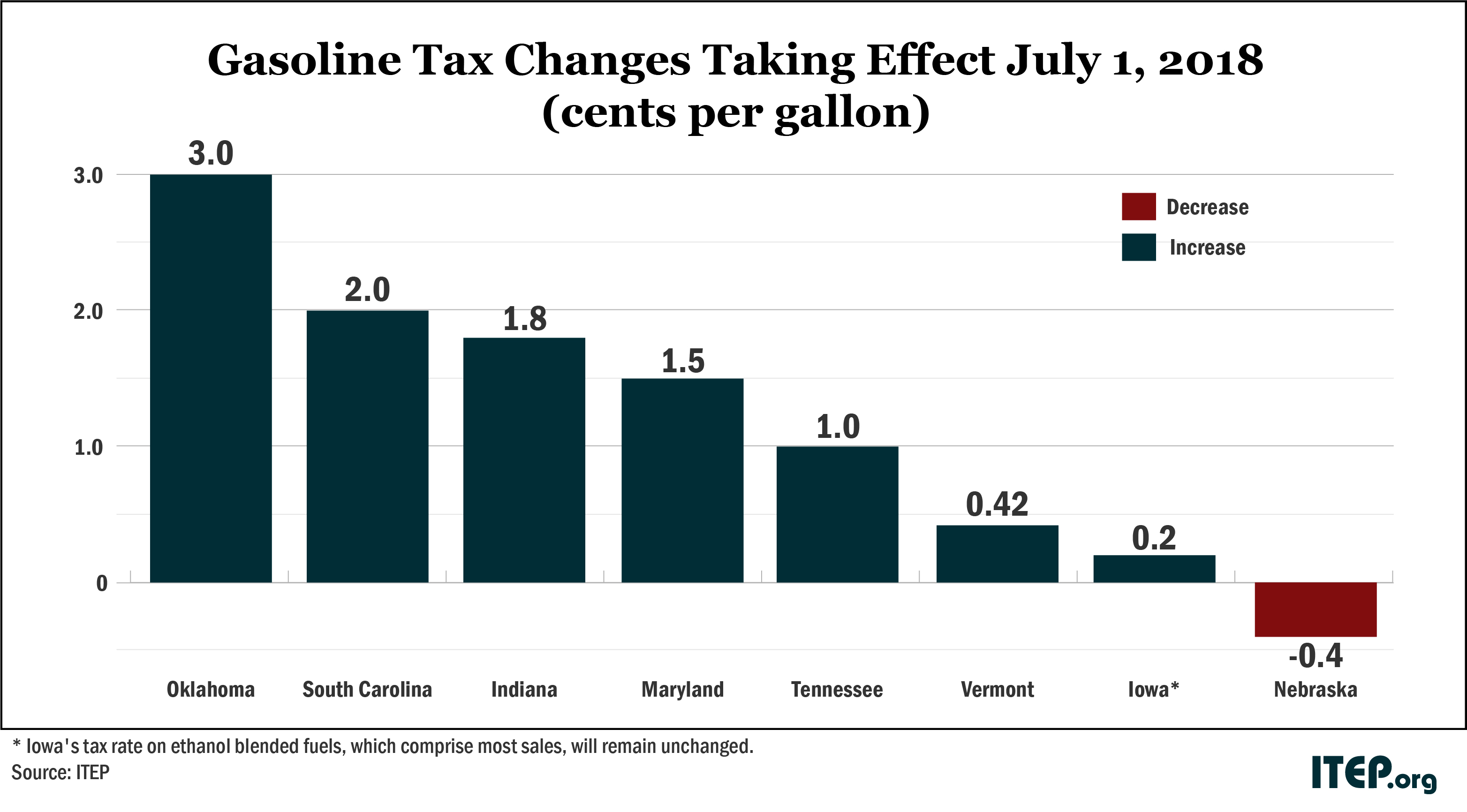

Most States Have Raised Gas Taxes In Recent Years Itep

General Fund Receipts Nebraska Department Of Revenue

Colorado Sales Tax Rate Rates Calculator Avalara

Gas Taxes Rise In Seven States Including An Historic Increase In Oklahoma Itep

Online Sales And Use Tax Filing Faqs Nebraska Department Of Revenue

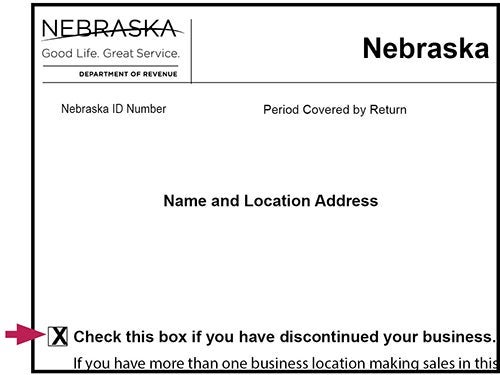

Closing Your Business In Nebraska Nebraska Department Of Revenue

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price